- How to Write a Job Description — Best Practices & Examples (2026 Update) - February 26, 2026

- 10+ Examples of Top Companies with Autistic Hiring Programs (2026) - February 23, 2026

- What I’ve Learned About AI, Rigid SaaS, and Job Content Since Joining Ongig in 2019 - February 17, 2026

Most people in talent acquisition don’t wake up thinking about FLSA classifications. But mislabeling a role as exempt or non-exempt? That can lead to lawsuits, fines, and frustrated employees.

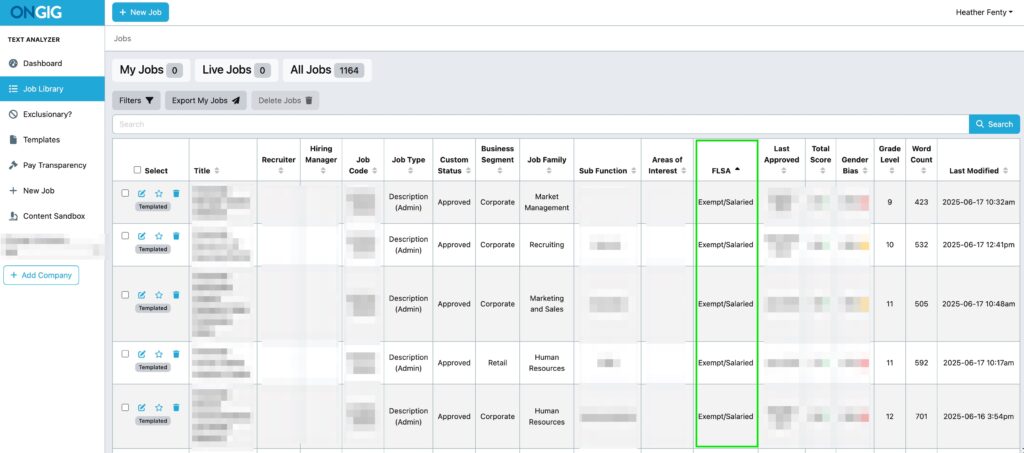

That’s why one of our clients added a custom “FLSA” column to their job description library. It’s been a game-changer for compliance and organization.

What Are the FLSA Job Description Requirements?

Under the Fair Labor Standards Act (FLSA), every U.S. job must be classified as either:

- Exempt – not eligible for overtime pay

- Non-exempt – eligible for overtime pay

To make this call, employers must assess:

- The salary level (currently $684/week minimum for exempt roles)

- The way employees are paid (salary vs hourly)

- The actual job duties — not just the title

It’s not enough to slap “Manager” in the title and call it a day. If the duties don’t meet the exemption test, the role may be non-exempt — and subject to overtime laws.

Why Job Descriptions Matter for FLSA Compliance

When there’s a wage dispute, your job description becomes Exhibit A.

If it clearly outlines duties that support an exemption (like supervising two or more full-time employees), great. If not? You’re at risk.

TA leaders and compensation teams need a way to track this across hundreds or thousands of roles. That’s where things often fall apart.

One Client’s Solution: A Custom FLSA Column

We work with a large client in the insurance space. Their challenge: thousands of job descriptions spread across different locations, and no consistent way to tag which roles were exempt or non-exempt.

We helped them create a custom “FLSA” column in their Ongig job description library. It allows them to:

- Visibly tag each JD as Exempt or Non-Exempt

- Search, filter, and sort by FLSA status

- Quickly identify which JDs may need review if exemption rules change

This isn’t about guesswork, it’s about building compliance into the workflow.

The Impact of Small Changes

With this one tweak, their legal and compensation teams now work smarter. Recruiters have clarity. And if the DOL ever comes calling? They’ve got organized, up-to-date documentation for every role.

It’s the kind of small operational shift that saves massive headaches down the line.

Takeaway for TA and HR Leaders

If your team is still managing job descriptions in a spreadsheet or shared drive with no FLSA tagging system, you’re playing with fire.

Instead, build FLSA classification into your JD management process. Whether that’s a custom column, a dropdown tag, or automation (you need a system).

Ongig makes it easy. You can track, sort, and update based on FLSA status — all from one searchable job dashboard.

Why I Wrote This

FLSA compliance doesn’t sound sexy, but getting it wrong can be seriously costly. I wrote this because we helped a client make one simple change (a custom “FLSA” column), and it made a big difference. It’s a reminder that smart structure = less stress. Let’s chat if you want to do the same.

FAQs

1. Do job descriptions have to include FLSA status?

It’s not legally required to include it in the text, but you must document how each role is classified and why.

2. What determines if a job is exempt or non-exempt?

FLSA status depends on salary level, how the employee is paid, and the specific job duties — not the title alone.

3. How does Ongig help with FLSA compliance?

Ongig lets you create a custom “FLSA” field to track status across your job descriptions and quickly search/filter them.

4. What happens if I misclassify a role?

You could owe back pay, penalties, or face lawsuits. That’s why accurate documentation is so critical.

5. Can I bulk update FLSA status in Ongig?

Yes — you can update tags across multiple job descriptions using templates and job attributes to stay aligned with changing laws.