- What’s the Difference Between a Job Description, Job Posting, and Job Ad - June 5, 2025

- Top 20+ Diversity Equity Inclusion Titles (with Descriptions) 2024 - October 18, 2024

- A List of Common Offensive (Exclusionary) Words Used in Job Descriptions (2024) - October 18, 2024

What are the optimal accounting job titles?

I asked my team to help me analyze which accounting titles work best. So, in this mini-report (the latest chapter in Ongig’s Job Titles: The Definitive Guide, you’ll find guidance on:

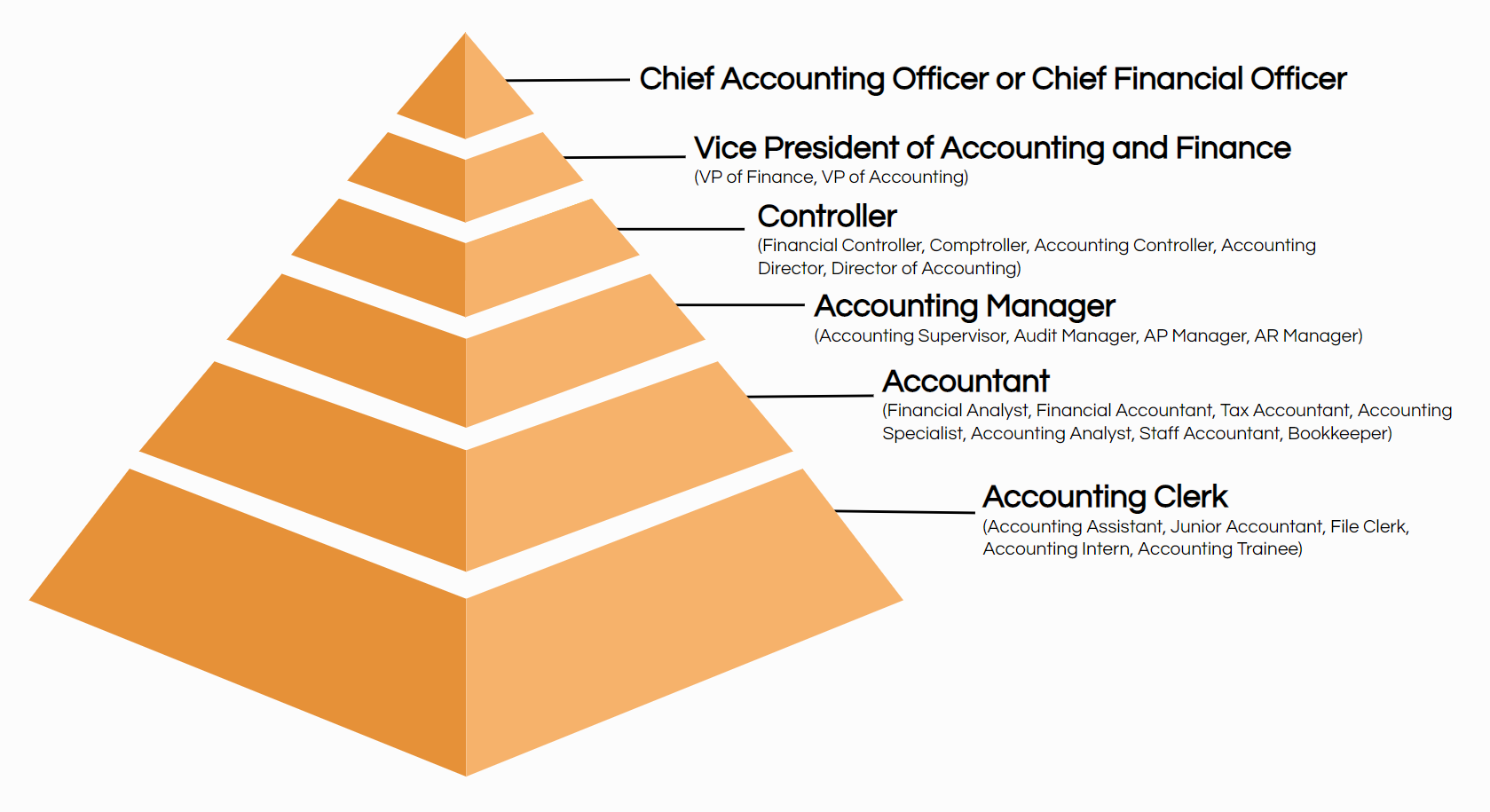

- Accounting Job Titles Hierarchy — The standard for accounting department positions

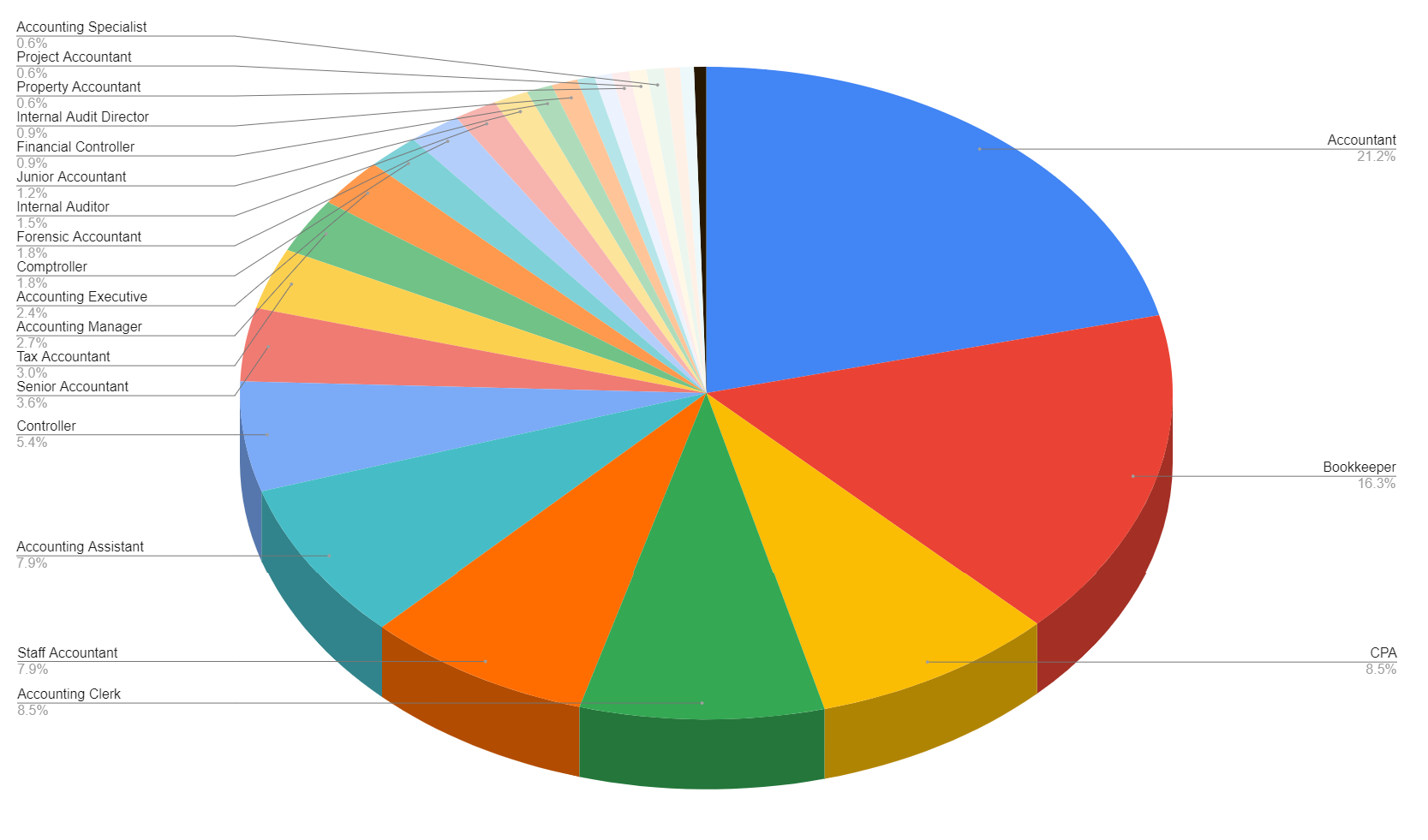

- Most Searched-For Accounting Titles — A pie chart of the top 22 accounting position titles candidates search for on Google.

- Accounting Job Titles and Descriptions — A list of the top 20 accounting titles and descriptions that employers request.

Note on the Hierarchy of Accounting Positions: Many employers have both Accounting and Finance together as one department or Accounting reports into Finance. For this article, I’m focusing on just Accounting positions as its own department — titles for Finance is a topic I’ll cover in a future article! However, I’ll mention Finance titles/positions in a couple of spots (especially leadership).

Accounting Job Titles Hierarchy

Accounting Job Titles: Management

The leader of most accounting teams is the Chief Financial Officer or Chief Accounting Officer (CAO). The CAO title, while less common, is used at major businesses including Dell and Allstate Insurance.

As in most departments, the #2 person on the accounting team is typically a vice president. While there are many different Accounting VP titles, the most common are VP of Accounting and Finance, VP of Finance, and VP of Accounting.

At the Director level, most Accounting departments use the title Controller (for-profit), Comptroller (non-profit and governments), or Director of Accounting/Finance.

Entry-Level Accounting Job Titles

Below are the most popular entry-level accounting job titles ranked by both candidate and employer searches on Google (source; ahrefs and Google Keyword Planner).

| Entry Level Accounting Job Title | Candidate Searches per mo. |

Employer Searches per mo.

|

| Accounting Clerk | 1,400 | 2,000 |

| Accounting Assistant | 1,300 | 1,100 |

| Junior Accountant | 200 | 200 |

| Accounting Intern | 60 | 300 |

You’ll notice that the candidate/employer job title search volume above is closely aligned except for “Accounting Intern” — that’s an entry-level title that candidates search for less compared to employer searches.

Top Accounting Job Titles (Candidates)

Below is a list of the top 22 accounting titles candidates search for (source: ahrefs and Google Keyword Planner).

Note for Employers: The titles listed above are the exact titles candidates search for. So, if you’re an employer for example, and you want to fill general accounting positions, titles that work best are “Accountant” followed by “Bookkeeper”, “CPA”, “Accounting Clerk”, etc.

Candidates who search these accounting titles on Google are also highly likely to search for the same titles on job boards like Indeed, LinkedIn, and Glassdoor. If you use a different title, the candidate is less likely to find you.

To make your hiring process even more efficient, tools like Manatal’s AI-powered ATS can help automate your job postings and ensure you attract the best-fit accounting candidates using data-driven insights.

Top Accounting Job Titles and Descriptions (Employers)

Below is a list of the top 20 accounting job titles and descriptions that employers search for via Google. These different accounting titles are ranked in descending order (source: Google search terms such as “[Job Title] Job Descriptions”). I’ve included synonyms for the positions where relevant.

1. Controller

A Controller (aka Comptroller) is responsible for overseeing and managing the accounting for a for-profit company. So, a Controller ensures that all financial reports are accurate and interprets data that is shared with the executives of a company. A director or above position on most accounting teams the Controller is also tasked with keeping the business in compliance with financial laws and regulations. A Controller is the same position as Comptroller with Comptroller more commonly used in government and non-profit organizations.

# of Google Searches for this title per Month: 6,000; Financial Controller: 500

2. Bookkeeper

A Bookkeeper is tasked with the day-to-day financial transactions in an organization. A Bookkeeper role is most common in small to mid-sized employers. An accountant will also review the work of the Bookkeeper in most organizations before finalizing monthly, quarterly, or annual financial statements.

A Bookkeeper’s daily tasks are to process and record transactions like:

- Sales

- Purchases

- Payroll

- Accounts receivable

- Bill payments

# of Google Searches for this title per Month: 4,600

3. Accountant

An Accountant manages financial information and processes for a business, either internally or externally. So, an Accountant is trained and qualified to do the following duties for an organization of any size:

- Bookkeeping

- Preparing Profit-and-Loss statements

- Performing financial audits

- Preparing tax reports

An accountant also advises on business structure, can manage invoicing and payroll, and keeps management in the know about tax law changes.

# of Google Searches for this title per Month: 4,100

4. Staff Accountant

A Staff Accountant works directly with the Controller/Comptroller in an organization to prepare and analyze organizational budgets. A Staff Accountant is responsible for maintaining financial records, general ledgers, and reports. In some organizations, a Staff Accountant may also manage accounts receivable and assets.

# of Google Searches for this title per Month: 2,100

5. Accounting Clerk

An Accounting Clerk provides general accounting support in the accounting department of an organization. So, the Accounting Clerk, usually an entry-level accounting position, has daily tasks such as:

- Verifying the accuracy of invoices

- Updating and maintaining accounting journals, ledgers, and records

- Data entry for accounting activities

- Reconciliation of records for employees and vendors

- Investigating data inconsistencies

# of Google Searches for this title per Month: 2,000; Accounting Assistant: 1,100

6. Accounting Manager

An Accounting Manager oversees the daily operations of an accounting department. Accounting Managers are responsible for establishing the proper accounting methods for a business and the enforcement of those policies. An Accounting Manager is expected to meet financial accounting objectives set by senior management and may also provide budget recommendations based on financial reports. They often report to the CFO.

# of Google Searches for this title per Month: 1,400; Accounting Supervisor: 250

6. Auditor

An Auditor conducts financial investigations for various businesses. An Auditor is an external and independent accounting professional who performs audits to ensure the accuracy of financial information within an organization. An Auditor’s duties also include:

- Verification of company assets and liabilities

- Laws and Regulations compliance

- Examining management policies and procedures for effectiveness

- Proposing new processes for financial improvement

# of Google Searches for this title per Month: 1,100; Internal Auditor: 300; Internal Audit Manager: 300

7. Senior Accountant

A Senior Accountant is responsible for reviewing journal entries of junior accountants and making recommendations based on their analysis. So, a Senior Accountant takes ownership of costs, expenses, and the productivity of an organization. Other responsibilities of a Senior Accountant include assisting with tax or financial audits, coordinating complex accounting projects, and preparing account reconciliations.

# of Google Searches for this title per Month: 800

8. CPA (Certified Public Accountant)

A Certified Public Accountant (CPA) is an accounting professional who has met licensing requirements from their state to manage accounting and tax practices for public businesses. The duties of a CPA are:

- Tax preparation services

- Auditing and review

- Forensic accounting services

- Financial planning

- Business valuation

- Financial litigation representation

# of Google Searches for this title per Month: 500; Certified Public Accountant

9. Tax Accountant

A Tax Accountant is responsible for ensuring that businesses and individuals are in compliance with tax laws. A Tax Accountant offers tax planning services and advice that assist businesses in saving money. Another role of a Tax Accountant is to prepare federal and state tax returns.

# of Google Searches for this title per Month: 450

10. Accounting Payable Clerk

An Accounting Payable Clerk is responsible for paying the outgoing invoices or bills on behalf of a company by using their expertise and various accounting and automation tools. An Accounting Payable Clerk is also known as an accounts payable clerk, and their jobs duties include:

- Responding to vendor invoices

- Paying company credit card bills

- Ensuring payments are sent when due

- Resolving payment disputes

# of Google Searches for this title per Month: 450; Accounts Payable Clerk: 300

11. Accounts Receivable Specialist

An Accounts Receivable Specialist oversees the billing and collection for an organization. An Accounts Receivable ensures that confidentiality is maintained when collecting payments from clients. Other duties of an Accounts Receivable Specialist include account reconciliation and cash receipt creation.

# of Google Searches for this title per Month: 300; Accounts Receivable Clerk: 250

12. Accounts Payable Specialist

An Accounts Payable Specialist works closely with the accounts payable clerk to monitor outgoing payments from an organization. This role also assists in keeping track of vendor payment agreements and logs outgoing invoices. So, an Accounts Payable Specialist reviews and reconciles reports within the payables department.

# of Google Searches for this title per Month: 300; Accounts Payable Manager: 300

13. Comptroller

A Comptroller is a highly ranked accounting professional in a government or non-profit organization. A Comptroller (similar to the Controller position in for-profit companies) manages expenditures to keep the organization in line with a pre-determined budget. Comptrollers also review all accounting activities to ensure high standards and make adjustments to budgets as needed.

# of Google Searches for this title per Month: 300

14. Cost Accountant

A Cost Accountant is tasked with examining, recording, and summarizing a company’s costs, including products and services. The work of a Cost Accountant helps organizations plan budgets and improve cost efficiency. A Cost Accountant records and also classifies expenditures to create financial statements for senior management.

# of Google Searches for this title per Month: 300

15. Accounting Representative

An Accounting Representative is the primary contact between and company and its clients. An Accounting Representative is responsible for creating and maintaining customer accounts. The essential duties of an Accounting Representative are:

- Client Communication and issue resolution

- Monitoring and responding to client communication

- Creating client invoices

- Auditing client files

- Collaborating with department heads across departments

# of Google Searches for this title per Month: 300

16. Accounting Intern

An Accounting Intern assists the accounting department with a variety of tasks. An Accountant Intern is responsible for basic office tasks such as making copies of client invoices or files. An Accounting Intern also works directly with upper-level accountants to prepare financial reports and tax returns, and to perform audits of client financial accounts.

# of Google Searches for this title per Month: 300

17. Accountant Specialist

An Accountant Specialist, also known as an Accounting Specialist, is tasked with managing the payroll activities of a business or organization. This includes reviewing employee contracts and time sheets to ensure accuracy. An Accountant Specialist is responsible for preparing reports for workers’ compensation claims and other federal or state reports. Depending on the size of the organization, this role may also include the management of accounts payable and receivable.

# of Google Searches for this title per Month: 300; Accounting Specialist: 150

18. Accounting Coordinator

An Accounting Coordinator is responsible for inputting employee payroll information on a weekly or monthly basis. An Accounting Coordinator also manages the contract filing systems and creates monthly financial statements. In some organizations, the Accounting Coordinator works across all departments to assist in creating annual plans.

# of Google Searches for this title per Month: 250

19. Forensic Accountant

A Forensic Accountant uses the combination of investigative and accounting training to examine the financials of a business or an individual. Forensic Accountants conduct audits and create reports that are legally acceptable in court cases and legal action based on their findings, commonly for embezzlement or fraud cases. A Forensic Accountant may also be called upon to testify in court and prepare additional visual aids based on their findings.

# of Google Searches for this title per Month: 250

20. Property Accountant

The Property Accountant addresses the requirements needed to buy and sell real estate. Job responsibilities include crafting budgets, setting up escrows, and preparing statements.

# of Google Searches for this title per Month: 200

Other Accounting Job Titles Resources

Thanks to the many experts on accounting positions I learned from for this report. They include:

- What is a bookkeeper? by Accounting Coach

- What Is an Accountant and What Do They Do? by Dave Ramsey

- What Does a Staff Accountant Do? by Laura Edward

- Who is an auditor and what are their duties by Kelechi Odimayo

- What is a CPA? What Does a Certified Public Accountant Do? by Becker.com

- The Role of Tax Accountants by Rose Johnson

- Cost Accounting Definition: Types, Objectives and Advantages by Toppr.com

- What Does an Accounting Intern Do? by Cynthia Gomez

- Accounting Specialist Responsibilities by Bob Kelly

- Forensic Accounting Definition & Examples by James Chen

Why I wrote this?

My team at Ongig is on a mission to transform job descriptions. A key to any job description/job posting is the job title. If you’d like more data/input on job titles, check out Job Titles: The Definitive Guide: Best practices on job titles including lists of titles by hierarchy and departments. The logic/data about job titles is built into Ongig’s job description software.